Cash flow per share formula

Lets assume that during the fourth quarter. Rated the 1 Accounting Solution.

Cash Flow Formula How To Calculate Cash Flow With Examples

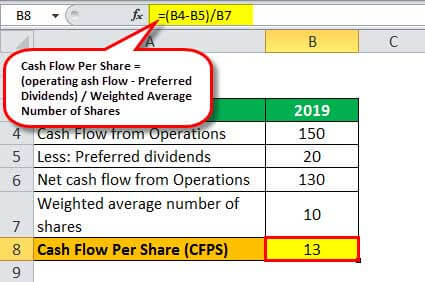

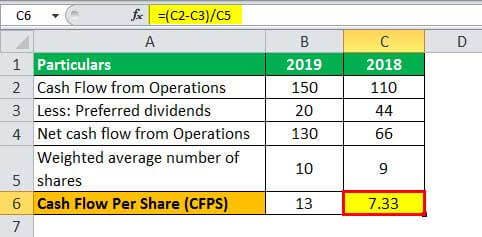

To calculate cash flow per share Cash flow per share of the company shows the cash flow portion of the company allocated against each of the common stock presents in the company.

. To calculate cash earnings per share you just need to divide your operating cash flow by the diluted shares outstanding. The formula for cash flow per share is. How to Calculate Cash Per Share.

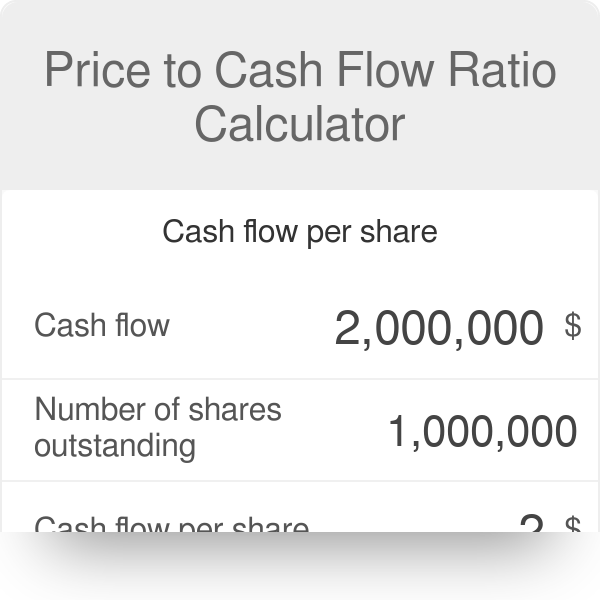

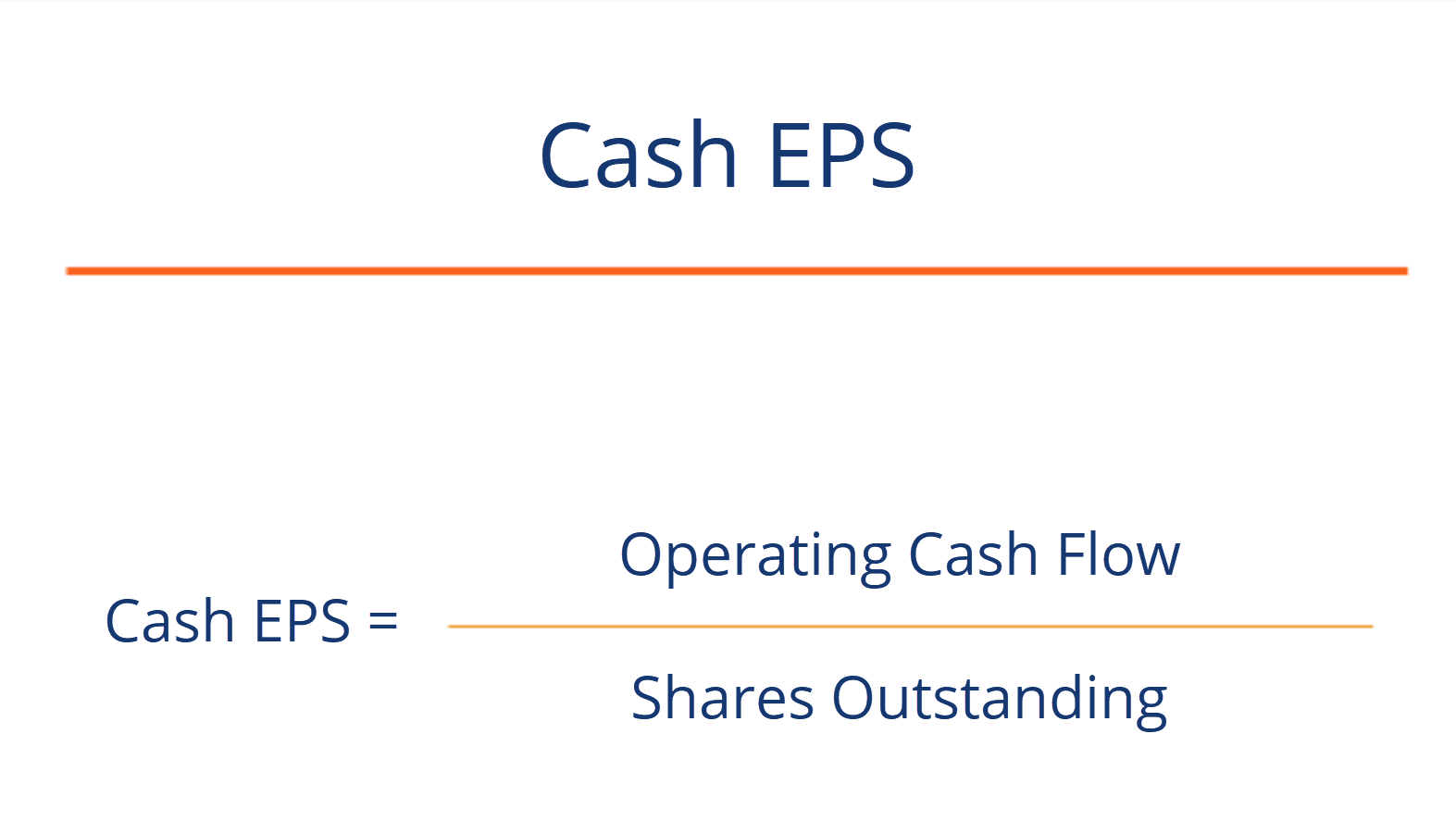

Cash Flow Per Share. BeginalignedtextCash EPS fractextOperating Cash FlowtextDiluted Shares. Cash Flow Per Share Operating Cash Flow Number of Outstanding Shares.

Why Do We Use Cash Flow Per Share. Operating Cash Flow Per Share Operating Cash Flow Number of Outstanding Shares. Cash Flow Per Share Cash Flow - Preferred Dividends Shares Outstanding.

Cash per share is the broadest measure of available cash to a business divided by the number of equity shares outstanding. The detailed operating cash flow formula is. Free CFPS free cash flow outstanding share.

Cash Flow Per Share Operating Cash Flows Preferred Dividends Total Number of Common Shares Outstanding. Operating Cash Flow Net income Depreciation and amortization Stock-based compensation Other operating expenses and. However there are numerous variations of the.

In this segment we will learn how to calculate Cash Per Share and use Apple Inc for a step-by-step example on calculating Cash Per Share. Ad QuickBooks Financial Software. Net Operating Profit After Taxes Operating Income 1 - Tax Rate and.

This makes cash flow per share a more transparent measure of a companys results than earnings per share which is subject to some obfuscation under the accounting. Operating Cash Flow Per Share Formula. So the formula would look like this.

Operating Cash Flow Per Share. Sometimes free cfps is used to. Cash EPS Operating Cash Flow Diluted Shares Outstanding where.

Free Cash Flow Net Operating Profit After Taxes Net Investment in Operating Capital where. Cash Flow Per Share is. Ad QuickBooks Financial Software.

Calculate the Cash Flow Per Share. Cashtext flowtext pertext share fracCFO - Preferredtext DividendWeightedtext Averagetext Numbertext Oftext Commontext. Free cash flow per share is determined by dividing free cash flow to command out shares.

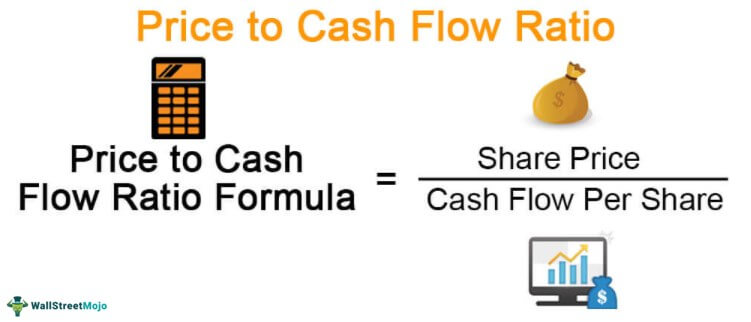

Rated the 1 Accounting Solution. Many analysts believe cash flow per share is a better measurement than earnings per share EPS because earnings per share can be more easily manipulated.

Cash Flow Per Share Formula Example How To Calculate

Price To Cash Flow Formula Example Calculate P Cf Ratio

Net Cash Flow Formula Calculator Examples With Excel Template

Price To Cash Flow Ratio Calculator Calculate P Cf Ratio

Cash Flow Per Share Formula Example How To Calculate

Cash Flow Formula How To Calculate Cash Flow With Examples

Fcf Formula Formula For Free Cash Flow Examples And Guide

Price To Cash Flow Formula Example Calculate P Cf Ratio

Cash Conversion Ratio Comparing Cash Flow Vs Profit Of A Business

Price To Cash Flow Ratio P Cf Formula And Calculation Excel Template

Cash Flow Per Share Formula And Calculator Excel Template

Price To Cash Flow Ratio P Cf Formula And Calculation Excel Template

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

Free Cash Flow Fcf Formula To Calculate And Interpret It

Cash Eps Operating Cash Flow Divided By Shares Outstanding

Cash Flow Per Share Formula Example How To Calculate

Free Cash Flow Formula Calculator Excel Template

Operating Cash Flow Ratio Formula Guide For Financial Analysts